ESIC ATO RULING

ESIC private ruling requests are lodged in an effort to confirm that a company is an eligible Early Stage Innovation Company in the eyes of the regulator. In our view rulings are good option available to companies who are intending to, or currently raising capital or indeed if they have already completed a round and wish to raise again, or simply add assurance to prior assumptions or assurances made around ESIC status.

ESIC assessment can be self assessed or established via the points test, which appears simple. However the ATO will not provide a ruling on a points qualification, so astute investors will be wise to get things down in writing.

So what is an ESIC Private Ruling?

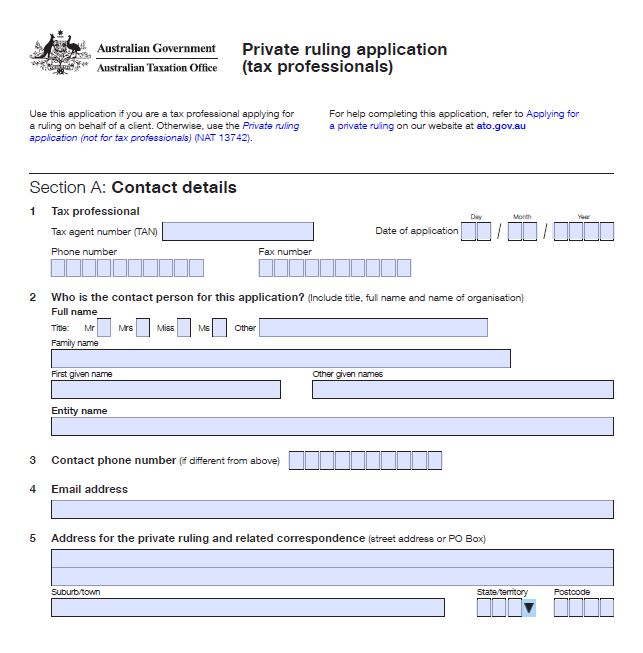

A private ruling is a written request to the commissioner, outlining the facts, presenting your ESIC tax credentials and requesting a judgement. We think of it as part audit and part tribunal case, which sounds scary! Though you should think of it as serious and professional undertaking.

Your job in presenting a ruling request is to outline the facts and evidence as they relate to the rules. If you’re not expertly familiar with ESIC, you will find this challenging, which is why most founders use an accountant or tax lawyer with experience in ruling requests and ESIC.

Over 100 ESIC ATO Rulings are lodged each year, so don't feel out of place, we can help direct you to someone who can assist.

What are the Benefits of an ESIC Private Ruling?

Binding on the ATO

Essentially, the ATO must stick to their determination*.

Full documentation

The process requires a full and timely presentation of the facts (something which will not be possible with an audit 10 years later)

Shareholder Loyalty

Given the Capital Gains Tax Exemption, ESIC shareholders have an extra reason to be loyal investors. Added certainty on the ESIC claim will help, with say, follow-on funding rounds.

What is the process of obtaining an ESIC Private Ruling?

The company must lead an application, even if it the investors who benefit directly from it. This is because the company has the relevant information available to support the claim it is eligible ESIC.

Even if an advisor is leading the lodgement, a founder or senior exec must take ownership of the process. Depending on the situation, skill and experience with ruling requests, you can expect 2-5 days pre lodgement and a day or more in follow-up post lodgement. The ATO may deal solely with the adviser and or with the founder as well.

Preparation time will vary based on the documented information available from the ESIC. Do you have a business plan, commercialisation strategy and competitive analysis? If not, critical elements of these documents must be prepared and collated into a useful format.

Upon lodgement of the application form with any attachments, you should expect a 4-week delay for the work to be allocated and contact from the ATO team member who is assessing your request.

The ATO will typically request additional documentation, have queries and need to understand the business model quite well before making a determination, this takes between one and six months. Yes it can take six months if the matter is highly technical and your claims are referred for expert review (e.g. via a CSIRO expert).

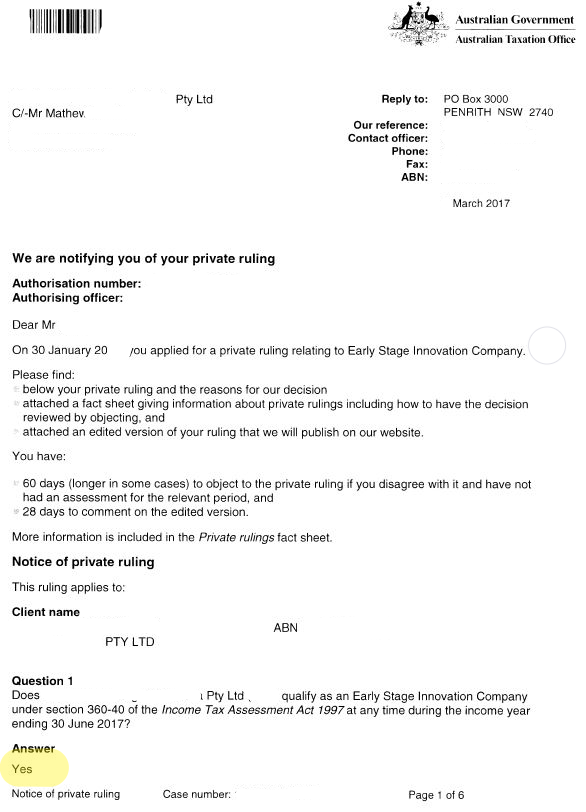

On completion you will receive a 40-60 page advise, inclusive of the determination, supporting tax technical assessment, depersonalised public version, investor guide and so on. If you are successful, it will clearly state the result and the applicable dates the ruling applies for.

If your ruling is unsuccessful, you have the option of taking the matter to the Tribunal and technically the ruling is only binding on the ATO, that said, we recommend you follow the ATO advice (unless otherwise advised by a professional in writing).

ESIC Private Ruling Tips:

Ask for exactly what you need, i.e. ask for confirmation of ESIC eligibility generally, not simply ESIC eligibility for a specific investor or share allotment.

Request the ruling cover a full tax year, i.e. lodging in September, for a ruling issued in December will provide cover through to the 30 June the following year, which may provide you another chance to raise funds before the ruling times out.

Stick to the facts, your ruling will be invalidated if you have provided false information in the application. Keep in mind that the ESIC is required to implement its business model in the way its described in the ruling.

Be thorough, the ATO could use material omissions as grounds for overturning the ruling.

Don’t go too early, ESICs are not company’s in R&D mode, you’ll need to show evidence of commercialisation, and ideally have traction with investors (if not committed funds).

Be Forthright, in our experience the ATO understand this is a tax incentive regime and founders are time poor, the applicants must show evidence, however you do not need to have achieved greatness to be ESIC, you are on the early stage of a wild journey!

What does an ESIC private ruling cost?

Consultants have been known to charge up to $25,000 for this work and as low as $2,000 (which is a worry). It is serious work with no shortcuts, so you should expect to pay from $5,000 to $9,000 at hourly rates of $300+GST

What happens after an ESIC Private Ruling?

The ATO will publish your ruling referring to the authorisation number that is the only mark that it applies to your company. Your investors should retain a copy of the opinion page (typically page 1 or 2) in their tax permanent papers.

Thereafter the company must still report to the ATO of all eligible ESIC investments made during the year, and investors should be reminded to claim the 20% tax offset.

An example ruling is attached for ease of reference and we encourage you to reach out to any of our tax advisers who can assist with this further.

*So does a ESIC Private Ruling provide absolute certainty?