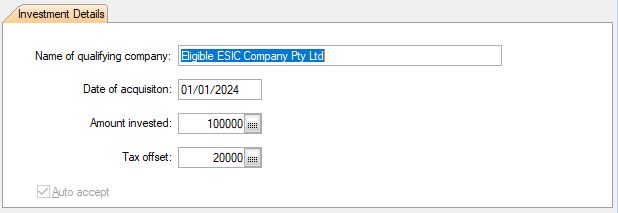

Claim 20% at T9 - Eligible ESIC Investors

If you are reading this it’s likely you have invested in an ESIC and are keen to recover your 20% Tax Offset in your personal tax return, at item T9.

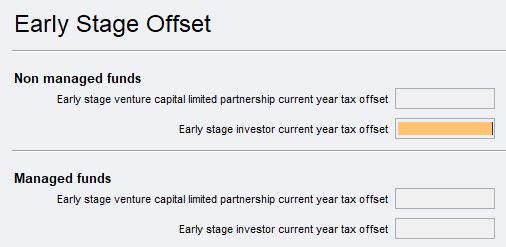

The box in T9 should include the total of all eligible ESIC offsets that are attributable to the taxpayer, be they prior year carry forward amounts or current year offsets.

The first thing you should ask is. ‘Did the company confirm my ESIC investment?’

Companies with ESIC investors are required to remit an Annual ESIC declaration with the ATO within 28 days of yearend, however they are not required to issue you formal paperwork to confirm this.

Even though the ATO should be notified, they will not automatically apply the offset. It’s up to you to confirm the company lodgement, and calculate the amount.

Why do I have to confirm my offset?

You need to confirm you are an eligible ESIC investor and the amount of the claim.

For example eligibility as an investor can be forfeit due to >30% ownership in the company.

The amount you can claim is limited by your investor status $10,000 for retail investors and a maximum of $200,000 for wholesale investors (or s708 sophisticated investors).

A ‘hard cap’ is applied to retail investments, whereas breach of the wholesale investment capped does not void eligibility to the concession.

Be sure to claim the 20% and not the full amount in T9 and be sure to see your tax agent prior to lodgement.