ESIC Annual Lodgement - Notifying The ATO

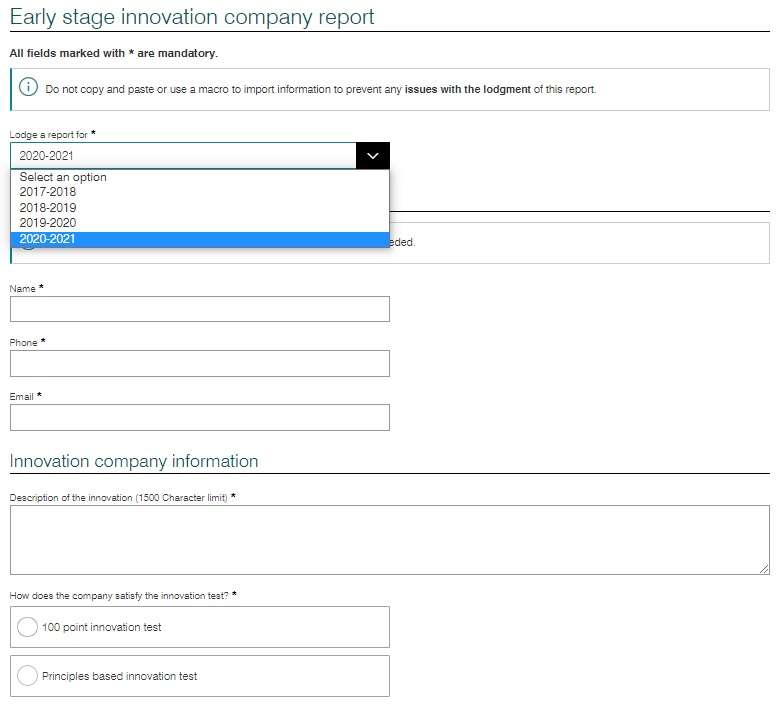

If you are a qualifying company that has issued new shares to investors who seek to claim the ESIC incentives you must lodge an Early Stage Innovation Company Report on or before the 31st of July each year, including all the details required in relation to the shares you issued in the prior year.

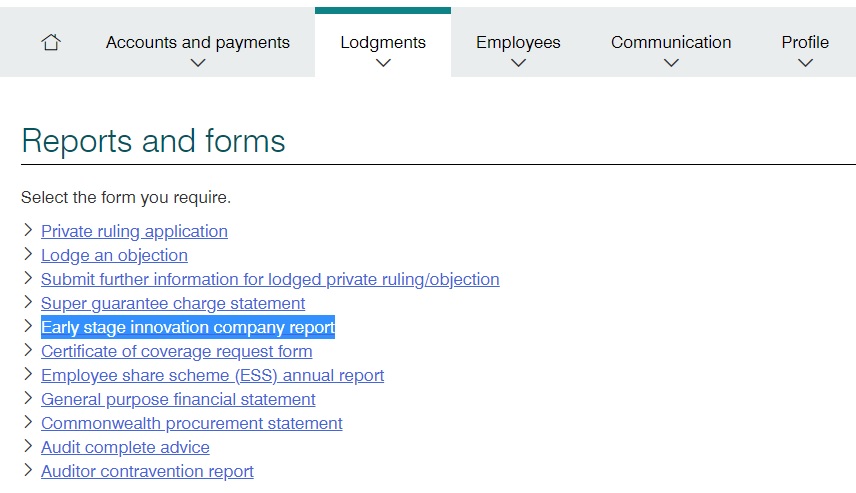

Lodgement is made via the your Tax Agent or the Business Portal (https://bp.ato.gov.au/)

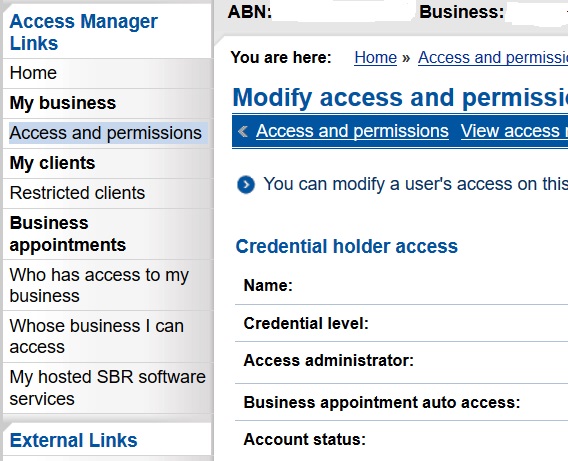

You will need appropriate access to to the portal which can be administered via the AUSKey or myGov login administrator. See https://am.ato.gov.au/home/default.aspx or contact your tax admin for your company.

To complete the lodgement you need investor details, including:

- ABN, name and address for the investor (including the date of birth for investors that are individuals)

- number of new shares issued to the investor

- amount paid for the new shares

- date the shares were issued

- percentage of shares in the company held by the investor immediately after the shares were issued

TIP

- Exclude investors who do not qualify. e.g. Affiliates, Founders and Employee shares (ESOP)

You will be asked to confirm the basis for the companies ESIC claim, being either the 100-point innovation test or the Principals-based innovation test.

If you do not use ATO online services expect this process to take time, you will need to establish your ATO online credentials, ensure you have appropriate access rights, the company linked to your Mygov ID, and correct navigation to find the appropriate report.

If you already lodge BAS online, we recommend you do this in house, if not, your tax agent is best placed to lodge, however you should still assist with compiling the shareholder data to help avoid errors in lodgement.

TIPs:

The report has a maximum of 20 investors, just start a new one to add extras

Keep the ATO Receipt ID

If you get stuck, your tax agent can lodge it on your behalf